Navigating Debt to Income Ratio for Homebuyers

Your Dream of Having a Home

Having your own home is a big dream for many people in India. But before you set off on this exciting journey, it’s important to know about something called the “debt to income ratio.” This helps you understand how much debt you can handle while still being able to pay for everything else you need.

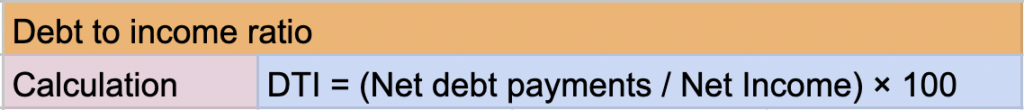

What is the Debt to Income Ratio?

Think of the debt-to-income ratio like a way to see if you can handle more debt. It’s a number that tells you how much of your monthly income goes towards paying debts. This includes things like loans, credit cards, and other payments.

How to Calculate the Number

To find your debt-to-income ratio, you add up all your monthly debt payments and divide that by how much money you make each month. For example, if you pay INR 30,000 for debts every month and earn INR 80,000, your ratio is 37.5%.

The Number You Should Aim For

Lenders, which are the people who give you money for buying a home, look at your debt-to-income ratio. They want to make sure you can pay them back. A good ratio is usually around 40-50%. This means about half of your monthly income can go towards paying debts, and the rest is for things you need every day.

As stated in Investopedia “A DTI of 43% is typically the highest ratio a borrower can have and still get qualified for a mortgage, but lenders generally seek ratios of no more than 36%.”

How It Works in India

In India, this debt-to-income ratio is important because people here come from different money situations. A lower ratio is better because it shows you can handle more debt without any problems. This is good for both you and the people lending you money.

Tips for You

- Make a Money Plan: Before you start thinking about a home, plan your money carefully. Write down how much you make, what you need to pay each month, and what you have left.

- Less Debt is Better: Try to pay off as much debt as you can before you get a home loan. This makes your debt-to-income ratio look better.

- Find a Home You Can Pay For: It’s nice to want a big fancy home, but it’s better to choose one that fits your budget. If your debt-to-income ratio is good, lenders might give you a loan for a home you can afford.

- Get Pre-Approved: This means checking how much money a lender can give you for a home. They look at your debt-to-income ratio and give you an idea of what you can spend.

What It All Means

The debt-to-income ratio is like a guide that helps you make smart choices when you’re buying a home in India. By understanding this number, you can make sure you’re not taking on too much debt. It’s like having a map that shows you the way to your dream home while keeping your finances safe and steady.